Published Works

Fact vs. Fear: Setting the Record Straight on Crypto Regulation

It's no surprise that the crypto universe has its naysayers. The concerns among this group were voiced in a recent Newsweek opinion piece that accuses the digital assets industry of seeking sweetheart legislation. Nothing could be further from the truth, writes Susan Joseph, a principal at the consultancy SusanJoseph LLC. In this article, Ms. Joseph resets the issues and playing field to clarify the crypto industry's goal for bipartisan legislation that provides…

The First Amendment: Freedom of Assembly Under Siege

Will the Trump Administration continue with Operation Choke Point 2.0., a program that is considered detrimental to the crypto financial marketplace? In this article, Susan Joseph, a principal at the consultancy SusanJoseph LLC, strongly opposes the program and says it is a violation of the First Amendment.

The First Amendment to the United States Constitution guarantees, among other fundamental rights, the right to petition the government and the freedom of assembly…

Bitcoin Reserve: An Idea Ahead of its Time?

Gold is the reserve asset of choice for many countries. But nothing hinders the U.S. from declaring bitcoin as a strategic reserve asset today, write Susan Joseph, a Principal at the consultant SusanJoseph LLC, and Craig Warmke, an Associate Professor at Northern Illinois University. While some may dismiss the idea as a self-serving ploy of bitcoin proponents, the U.S. would do well to support financial freedom and first amendment rights while exporting these values peacefully at the same time, they explain…

Don’t Blame Crypto

Although the regulatory framework around the digital asset space is still developing, companies and their boards are in the business of growing and protecting stakeholder value and must embrace sound internal risk management and external reporting, regardless of the state of regulatory clarity, write Susan Joseph, Principal at SusanJoseph LLC, and Elizabeth Menke, Managing Director at Bentley Associates. The basic groundwork for risk management and external reporting frameworks…

Research Note for Bridging the Bitcoin Holder Gap

Bitcoin is a unique and novel asset that can facilitate peer to peer electronic transactions without intermediaries. It is grounded in open source technology, economics, psychology, cypherpunk ethos and boasts a vigorous distributed and wide ranging community. Many compare Bitcoin to digital gold and see it as an asset that is maturing into a store of value...

Bridging the Bitcoin Holder Knowledge Gap

The traditional financial world has a gaping Bitcoin education gap that impacts regulators and asset holders, alike. Regulators fear the anonymous nature of Bitcoin; however, their concerns can be alleviated through innovative solutions like tracking activity and leveraging AI/machine learning to detect anomalies before requiring identification...

All About Cryptocurrency

Recent events in cryptocurrency have happened at a whirlwind pace. Listen to what Professor Sarah Kreps (Director, Cornell Brooks School Tech Policy Institute) and Susan Joseph (Executive Director, FinTech at Cornell), an initiative of the Cornell SC Johnson Graduate School of Management, think about the events leading up to FTX's bankruptcy filing.

Privacy in a Technological Age

In our data-driven society, privacy as a fundamental right should be recognized and upheld. We must adopt strong legal and technological protections that preserve our autonomy. Legally speaking we must establish a…

Diversity and Inclusion Shouldn’t Just Be Buzzwords

Blockchains are systems of governance written into code, algorithms dictating how users behave. The question of who gets to develop these systems and these rules becomes immensely important. Joining “Money Reimagined” hosts Michael Casey and Sheila Warren are Susan Joseph, executive director of fintech at Cornell, and…

How CBDC’s May Impact Inflation

With momentum building behind CBDCs, it is time to ask about how this new form of money will impact our every day lives. Privacy/anonymity issues come to mind as well as what type of impact will these currencies have on inflation. Given the recent extraordinary monetary policies that have been implemented around the world, this article explores the potential impact CBDCs will have…

Central Bank Digital Currencies — Some Considerations

In this far-ranging analysis of Central Bank Digital Currencies (CBDC), there is plenty to think about and digest. Would everyone have their own CBDC account? How would a CBDC impact commercial banking? What will the technology look like? These are a few of the questions raised in this article co-authored by Andrew Fately, Executive Director, Foreign Exchange, at Sumitomo Mitsui Bank, and Susan Joseph, Founder and Principal at SusanJosephLLC, a consulting firm…

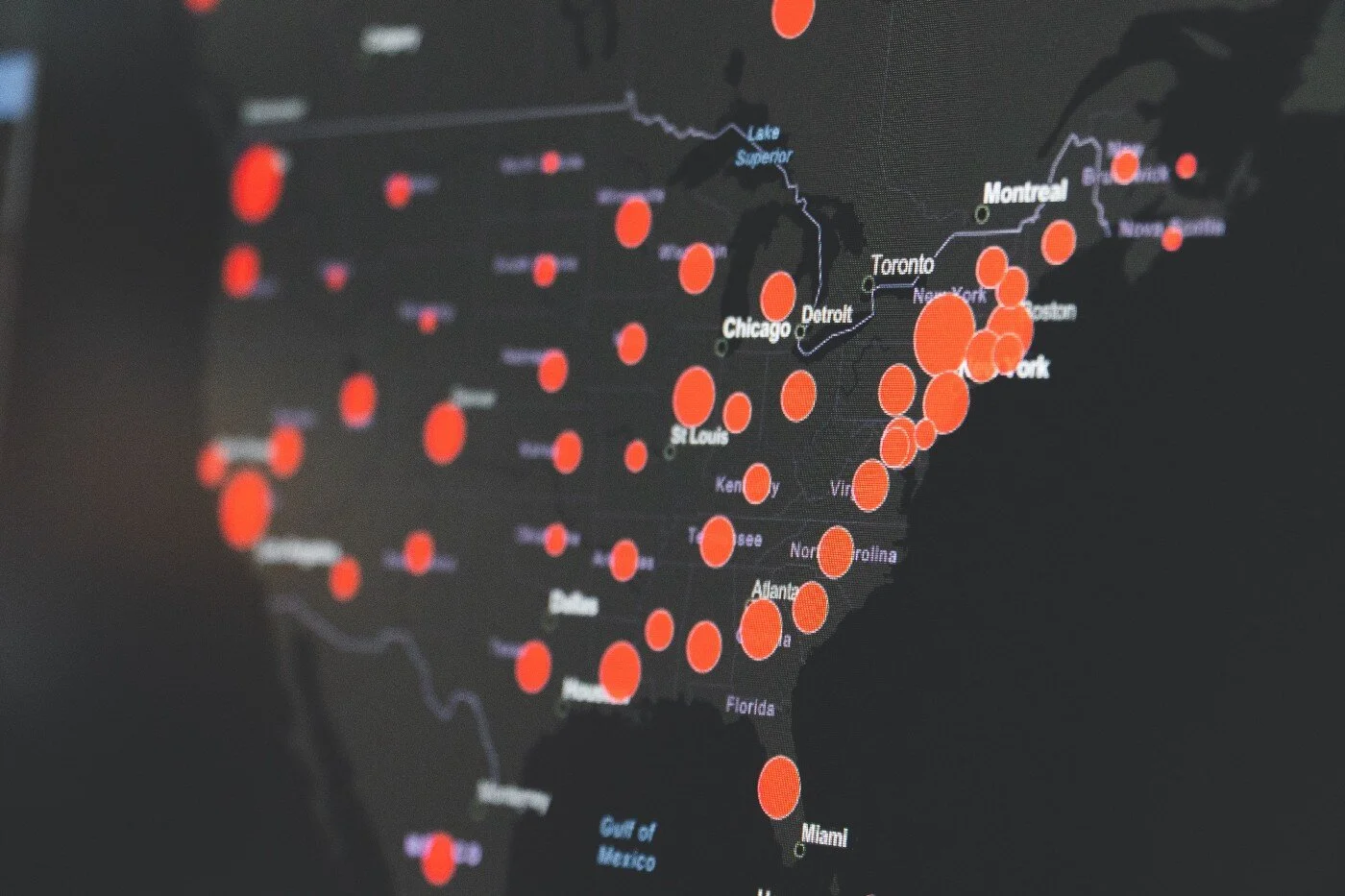

CoronavirusAPI Public Health Initiative

Data projects are hard work, but since mid-February a group of friends with backgrounds in law, economics, programming, data science and blockchain have been building something for the HELPERS. The completely self-funded effort has built an easily accessible public resource in a matter of weeks that makes actionable the 50+ different officially published state health records on Coronavirus…

State of Diversity and Inclusion in Blockchain

Blockchain technology provides a “digital ledger” that enables peer-to-peer interactions with minimal trust required between parties. Its focus on minimized trust is exciting because business and civil society need trusted interactions to function well. The technology has broad potential, ranging from fundamentally ordering transactions to running shared business and market processes with peers within and across verticals. While the technology is still nascent and emerging, Gartner predicts that this technology will generate $3.1 trillion in new business value by 2030 and believes that businesses can expect more mainstream adoption through 2023.2 It is quite possible that this technology will provide a new foundation for digital interactions that will affect our communications, identification, and financial transactions. This report analyzes diversity and inclusion in the blockchain sector today and recommends some actions and Best Practice standards that can be developed and adopted…

Diversity in Blockchain’s Initial Review of Facebook’s Project Libra

Facebook is leading an initial private group of 28 entities -- including some of the world’s most well-known brands -- to introduce a permissioned blockchain called the Libra blockchain, a cryptocurrency called Libra, and an independent governing association called the Libra Association “to enable a simple global currency and financial infrastructure that empowers billions of people.”

“Facebook teams played a key role in the creation of the Libra Association and the Libra Blockchain, working with the other Founding Members. While final decision-making authority rests with the association, Facebook is expected to maintain a leadership role through 2019. Facebook created Calibra, a regulated subsidiary, to ensure separation between social and financial data and to build and operate services on its behalf on top of the Libra…

Paradise is not Lost: The Win-Win of Privacy Rights and Self-Sovereign Identity in a Data-Driven Society

What does privacy as a fundamental right mean? How does that right fare in a data-driven society? How can we protect privacy through both legal and technological measures? Can blockchain technology help protect digital identity…

The Care and Feeding of the Crypto Ecosystem: New State Licensing is a Win

Like many immature markets, the crypto-marketplace witnessed a roller coaster of engagement for cryptocurrencies and digital assets. They have cycled from being red hot to facing a crypto-winter and are now fighting back for a legitimate place at the investment table. As both a potential inhibitor to growth and an enhancer to the structure, cryptocurrencies and digital assets fall under the purview of numerous government regulators…

Being Smart About Your Smart Contract

Timing is everything! And now is the time that the digital asset and cryptocurrency space work with Global Regulators in order to widely adopt this emerging technology and ecosystem. These Regulators have issued a number of new statements, cautions, and taken actions, since we published our article on October 2nd, 2019, entitled “Being Secure About Your Security Token Offering.”

In this article, we are bringing forward some additional information, observations and suggestions to the digital asset…

Being Secure About Your Security Token Offering

Over the past several years, we have witnessed the rise of digital, tokenized assets attempting to break out of the confines of stock exchanges and illiquid private investments. Security Tokens are the third category of tokenization, different than Cryptocurrencies (Bitcoin, Ethereum, etc.) and Utility Tokens, in which the tokens represent fractional ownership in a potentially broad range of financial investments or hard assets. The marketplace has been slow to fully embrace this new paradigm in investing, but tides are changing. More frequent announcements of asset tokenization are being released, while sizable pools of investors become educated and…

Rating Innovation, An Innovator’s Take

Ratings matter! Every company with a public credit or other rating understands that. Boards of Directors understand that. Markets understand and react to ratings. So it is big news when new or additional types of ratings are proposed by a rating agency or publisher. Recently, the insurance industry received a wake-up call when AM…

Do Blockchains and Consortia go Together like PB & J?

Over the past few years, there have been many high profile consortia formed to address blockchain technology. Deloitte estimates there are more than 40 consortia globally. Many are significantly funded by participants within or across industry verticals, VCs or a combination. What is it about the technology that creates such…